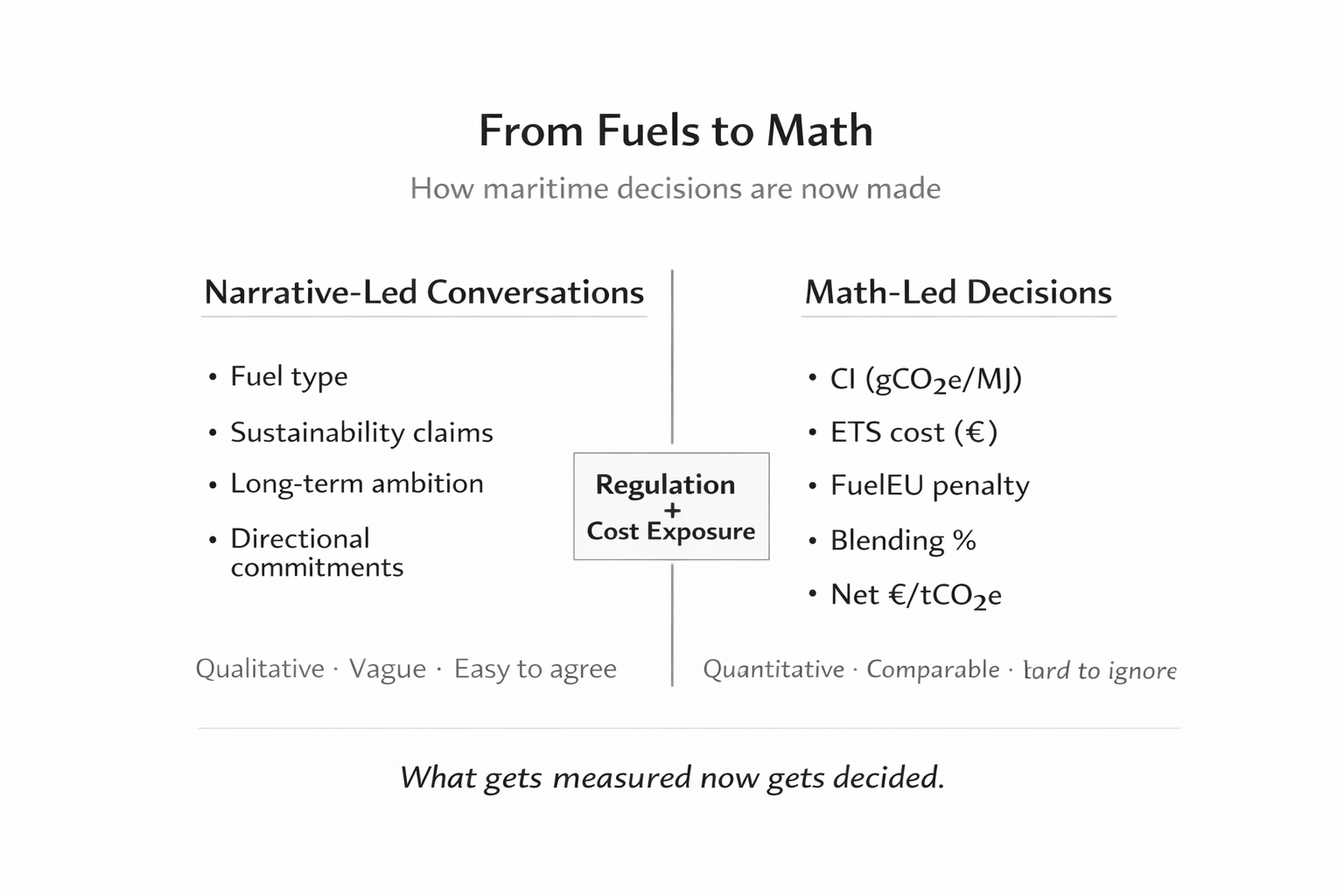

From Fuels to Maths: How Maritime Conversations Are Changing

As FuelEU Maritime takes effect and EU ETS requirements tighten, the global shipping industry is hitting a critical inflection point. For shipowners, the strategic priority has shifted. We are moving away from simple fuel procurement and toward Total Cost of Compliance (TCC) optimization. If you are navigating the transition from fossil fuels to Bio-LNG, Methanol, or Ammonia, the primary question is no longer just "What is the price per tonne?" Instead, the board is asking: "What is our cheapest path to regulatory compliance?"

In this learning note, I break down the spreadsheet-driven reality of the new maritime era, where fuel is no longer a commodity, but a financial hedge against carbon penalties.

The old conversation: “What fuel should I bunker?”

For decades, bunkering conversations were a tactical operation focused on ISO standards, availability, and delivered price.

Decarbonisation has ended that era. Today, fuel choice is just one variable in a complex compliance equation. Whether you are an operator or a bunker supplier, success now depends on solving for two distinct European regulatory levers that treat carbon very differently:

EU ETS: The "Tax" on Absolute Emissions

The EU Emissions Trading System (ETS) is a mass-based regulation. You pay for every tonne of CO₂ emitted. Think of it as a carbon tax with a fluctuating market price. To reduce cost, you must either burn less fuel or switch to zero-rated alternatives.

FuelEU Maritime: The "Speed Limit" for Intensity

FuelEU is a performance-based standard that targets the GHG intensity (gCO₂e/MJ) of the energy used on board. It sets a declining baseline. If your fuel mix is "dirtier" than the target, you pay a penalty. If it’s "cleaner," you create a compliance surplus. This surplus can be banked, borrowed, or pooled across a fleet to offset non-compliant vessels.

The new conversation: “What is my cheapest path to compliance?”

Here is the key change, and it took me time to internalise: No customer buys biomethane because it’ is green.

They buy it because it is a tool to manage compliance cost. Once you accept that, the conversation becomes clearer, and more honest.

For senior operators and BD professionals, the vocabulary of the bunker desk is evolving. Expect your teams to start asking:

"What is our ETS exposure per voyage at current EUA price levels?"

"At what blend percentage do we flip from a FuelEU penalty to a surplus?"

"Can we leverage fleet-wide pooling to delay retrofitting costs on older assets?"

"How does this fuel choice impact our CII rating vs. our FuelEU balance?"

A simple example

Assume a vessel operating in EU waters that burns LNG, and faces ETS cost on emissions and FuelEU penalty for missing the intensity target. Now introduce biomethane (or Bio-LNG), but only partially.

Scenario A: Do nothing

Burn fossil LNG, Pay ETS allowances, FuelEU penalty. This is the baseline compliance cost.

Scenario B: Blend 10–20% biomethane (via mass balance)

This is where Math fun comes in.

ETS - Biomethane is treated as near-zero CO₂. You reduce ETS exposure proportionally.

FuelEU - The average fuel intensity improves. Penalty shrinks, or flips into surplus.

The real question is : Is the cost of biomethane lower than the compliance cost it avoids? So the "Green Premium" is not a cost. It is a premium paid to avoid a significantly higher "Compliance Penalty."

The bottom line

In the energy transition, compliance economics is the new decision engine. Regulators care about different things, are no longer just asking for "green" intentions; they are demanding quantitative results.

To lead in this space, you must become conversant in the nuances of each policy:

ETS cares about how much you burn.

FuelEU cares about what you burn.

Success depends on how well you balance both.