Maritime Regulation & Recognition

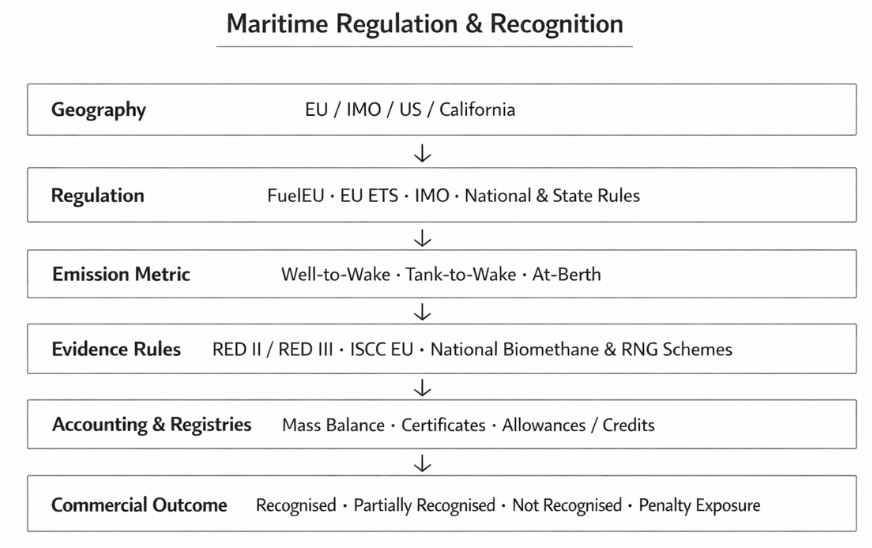

Shipping decarb is now an accounting game with real financial implications. The same molecule can look “clean” in one place and “non-existent” in another, depending on the rulebook, metric, and registry trail.

This explainer aims to provide a practical recognition matrix by geography + sector summary, based on EU renewable energy law (RED II / RED III), certification systems (ISCC EU), shipping regulations (FuelEU Maritime, EU ETS), and national biomethane/RNG schemes. This distinction only matters because certification, carbon intensity, and MRV play different roles in how emissions are recognised.

TLDR: The recognition matrix (the part to remember)

EU Shipping: Well-to-Wake (WtW) and Tank-to-Wake (TtW); backed by RED III + certification.

IMO: WtW-focused; global framework still under negotiation (target 2026).

US Federal: Proposed lifecycle intensity; currently lacks enforcement teeth.

California: Focused on local air emissions (at-berth); "green" fuel does not bypass shore-power rules.

Biomethane/RNG: Highly fragmented; recognition depends on national registry acceptance.

Maritime industry winners won’t be the companies with the boldest net-zero claims, but the ones that understand how regulation turns emissions into accounting entries, and accounting entries into money.

EU / EEA — where rules already hit cash flows

The EU is the first mover in turning carbon into a hard cost. If your vessel is ≥ 5,000 GT and calling at EU ports, you are playing by two sets of rules:

EU ETS, effective Jan 1, 2024: Measures TtW or "stack" emissions. You pay for what you emit.

FuelEU Maritime, effective Jan 1, 2025: Measures WtW lifecycle emissions. It penalizes fuels that have a high carbon footprint from production to combustion.

What determines sustainability recognition

Lifecycle values come from regulatory defaults, unless proven otherwise

Sustainability claims rely on RED II / RED III rules; pay attention to feedstock eligibility under annex 9

Mass-balance accounting is allowed, but only with approved certification

ISCC EU is commonly used to evidence sustainability and traceability

Important nuance

100% of emissions counted for intra-EU voyages; 50% for EU - non-EU legs

Without a certified "Mass-balance" trail, your green fuel is treated as standard fossil fuel by the regulators, leading to unexpected penalties.

Note to Shipowners invested in the LNG pathway: Starting from 2026, EU ETS will expand to include Methane (CH4) and Nitrous Oxide (N2O). Ships using Low-Pressure Otto-cycle engines (with methane slip up to 3.1%) face a massive spike in ETS costs. Investing in High-Pressure engines (0.2% slip) may be the most appropriate financial hedge against punitive "Methane Cliff" penalties.

International (IMO): the global lane, pending

The IMO is moving toward a global WtW accounting standard to ensure the industry does not just "offshore" its emissions to fuel refineries.

Timeline: A full "Net-Zero Framework" is expected by October 2026.

Strategy: While the IMO is the "global lane," the EU’s current rules are the de facto blueprints. If you are compliant in Europe, you are likely ahead of the global curve.

United States — Federal ambition vs. California reality

The U.S. market is currently split between "what might happen" and "what is happening."

Federal (Proposed Clean Shipping Act 2025): Focuses on lifecycle carbon intensity, green corridors and technology deployment. It aligns with the FuelEU’s logic but lacks a matching carbon price (for now).

California (CARB): This is about at-berth emissions i.e. local air quality, not global warming, for ocean-going vessels calling at regulated California ports. Includes container, tanker, Ro-Ro, cruise (by phase-in). Even if you use carbon-neutral methanol or RNG, you are still required to use shore power or capture systems at the berth.

National biomethane & RNG schemes

These schemes do not regulate ships directly. They determine renewable gas attributes.

Germany: Has registry-based biomethane tracking (gas grid accounting)

Italy: Has robust transport-focused biomethane credits (CICs)

UK: Uses Renewable Transport Fuel Obligation (RTFO) credits for transport fuels, which do not always have automatic recognition in the EU

USA: RNG tracked via RINs under the Renewable Fuel Standard

Critical point

Certificates are not universally portable. You cannot assume a "green" certificate from the US will offset a penalty in Rotterdam. Recognition depends on Chain-of-Custody logic and preventing "double counting." If two different entities claim the same molecule, the regulator can void both. Recognition depends on accepted sustainability rules, chain-of-custody logic, and registry controls that prevent double counting.