Biomethane Commercialisation (not one, but three ways…)

Biomethane demand is now being pulled by three sectors that want very different things: power wants scalable claims, road transport wants quota compliance, and maritime wants audit-proof decarbonisation that survives regulators and charterer scrutiny. In reality, it is becoming a regulatory instrument that behaves very differently depending on where the molecule flows and whether the claim survives verification.

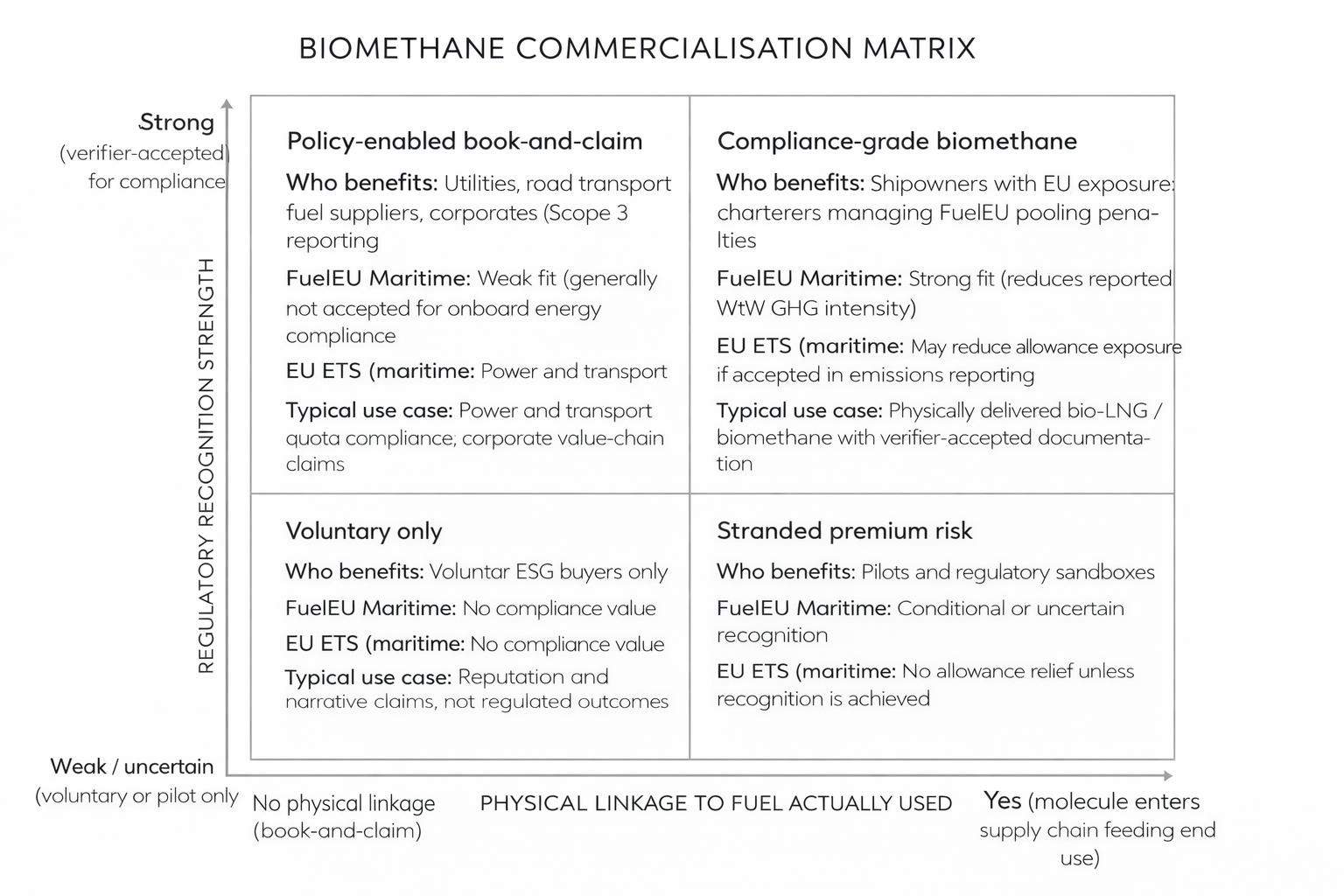

The easiest way I find to see this is using a 2×2 matrix:

(This article is designed to be read alongside the above “Biomethane Commercialisation Matrix” visual.)

X-axis: Physical linkage to fuel actually used

From no physical linkage (book-and-claim) to molecule entering the supply chain feeding end use.

Y-axis: Regulatory recognition strength

From weak or uncertain to strong, verifier-accepted for compliance.

Quadrant I — Physical + Recognised (Compliance-grade biomethane)

This is where biomethane functions as a genuine compliance lever.

Here, biomethane (or bio-LNG) is physically delivered into the supply chain, and the associated documentation is accepted by verifiers as changing regulated outcomes.

For FuelEU Maritime, this is the strongest fit. The fuel lowers the reported well-to-wake GHG intensity of energy used onboard and directly contributes to compliance balances.

For EU ETS (maritime), the logic is stricter. ETS is emissions-based. This quadrant only matters if emissions reporting and assurance frameworks accept the biofuel treatment in calculating verified emissions. When that hurdle is cleared, the benefit shows up as reduced allowance exposure.

Who benefits:

EU-exposed shipowners, charterers managing FuelEU pooling penalties, and suppliers able to sell defensible decarbonisation rather than discounts.

Worked example:

Certified biomethane liquefied and mass-balanced into LNG that is physically bunkered to EU-trading vessels, with attributes retired at end use and recognised GHG factors applied in FuelEU reporting.

Quadrant II — Physical + Not (Yet) Recognised (Stranded premium risk)

Here, the molecule is real and physically delivered, but the regulatory claim fails to recognise it.

This typically happens because of scheme mismatch, unclear mass-balance boundaries, or gaps between certification logic and what verifiers are willing to accept in practice.

Under FuelEU, this creates risk: the fuel may still be used, but the intended GHG benefit can be rejected or defaulted, eroding the economics.

Under EU ETS, nothing changes unless the emissions accounting explicitly recognises the claim. Allowances must still be surrendered against verified emissions.

This quadrant is where many pilots and early cross-border structures temporarily sit.

Who benefits:

Sandbox participants and buyers willing to experiment (pilots), often only with downside protection.

Commercial reality:

Deals here must be priced conditionally: a base fuel price, a premium payable only upon recognition, and explicit fallbacks if recognition fails.

Worked example:

North American biomethane attributes paired with LNG delivered into a non-EU terminal, where downstream FuelEU recognition depends on sandbox approval or evolving guidance.

Quadrant III — No Physical + Recognised (Policy-enabled book-and-claim)

This is where biomethane scales, but not in shipping.

The molecule remains local. The environmental attribute (EA) moves via a recognised registry or national scheme. This structure is widely accepted in power generation, road transport quota systems, and corporate renewable gas claims.

For FuelEU Maritime, the fit is weak. FuelEU is anchored to energy used onboard; attribute-only claims are not recognised unless explicitly accepted under reporting guidance.

For EU ETS (maritime), certificates do not reduce surrender obligations. ETS responds to measured emissions, not attribute retirement.

This quadrant is only fit-for-purpose outside maritime.

Who benefits:

Utilities, road transport fuel suppliers (blenders), and corporates optimising cost per tonne of reported reduction, particularly for Scope 3.

Worked example:

Biomethane injected into a national gas grid, with attributes transferred cross-border and retired against a power utility’s renewable energy obligation.

Quadrant IV — No Physical + Not Recognised (Voluntary only)

This is the cleanest quadrant conceptually, and the weakest economically.

Attributes here cannot be used for the intended compliance purpose due to geography, registry exclusion, or scheme mismatch. They carry no FuelEU or ETS value and cannot offset penalties or surrender obligations.

Who benefits:

Voluntary ESG buyers only.

Worked example:

RNG certificates marketed to shipping without any accepted linkage to onboard fuel use or emissions reporting.

The Bottomline

The winners in biomethane will not be the lowest-cost producers. It is a regulatory strategy and deal-design question. If you are in the biomethane market today, which quadrant are your deals in today, and what happens if it moves?