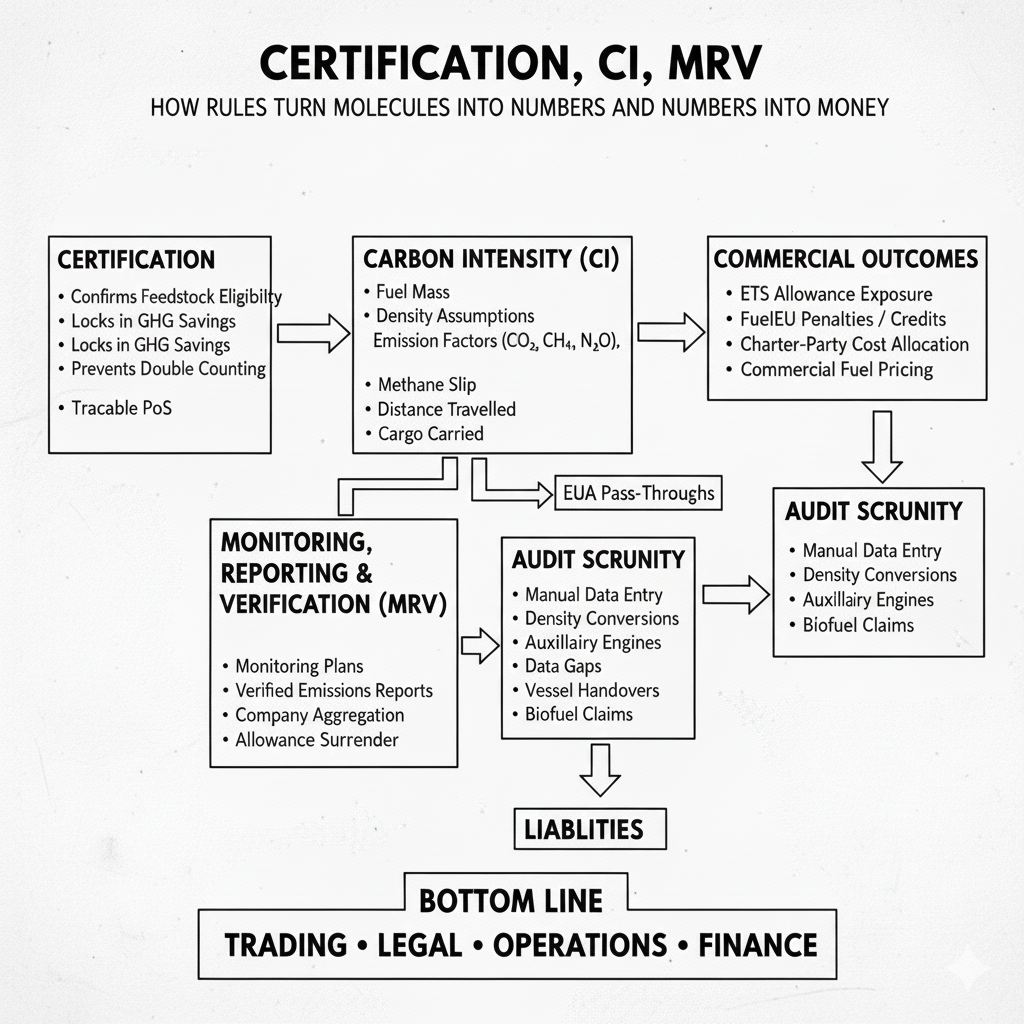

Certification, CI and MRV Mechanics

This explainer sets out how Certification, Carbon Intensity (CI), and Monitoring, Reporting & Verification (MRV) actually work together in practice, and where most companies get exposed.

Certification: when “green” only counts if it’s recognised

Burning a low-carbon fuel is not enough. What matters is whether regulators recognise it.

Under EU rules, fuels are only treated as zero- or low-emission if they meet RED sustainability and GHG-saving criteria and are backed by an approved certification trail. No certificate, no benefit.

What certification really does:

Confirms feedstock eligibility

Locks in lifecycle GHG savings

Prevents double counting

Creates a traceable Proof of Sustainability (PoS)

This is why biofuels and biomethane are routinely rejected at audit stage. The molecule may be clean. The paperwork isn’t. Hard truth: certification is a gatekeeper to regulatory recognition.

2. CI: where small data errors become big money

CI looks technical. It isn’t. It’s math, and extremely sensitive math.

Carbon intensity outcomes are driven by a handful of high-leverage inputs:

Fuel mass, not volume

Density assumptions

Emission factors (CO₂, CH₄, N₂O)

Methane slip for LNG

Distance travelled

Cargo carried

Get any of these slightly wrong and your CI result shifts materially. That shift directly feeds:

ETS allowance exposure

FuelEU penalties or credits

Charter-party cost allocation

Commercial fuel pricing

Rule of thumb: Know the variables that move your CI the most.

3. MRV: the system that turns emissions into liabilities

MRV is where emissions become auditable obligations. The launch of EU ETS Maritime in Jan 2024, ships above 5,000 GT calling EU ports must operate a full annual compliance cycle:

Ship-specific Monitoring Plans

Verified Emissions Reports

Company-level aggregation

Allowance surrender against verified tonnes

The system is unforgiving:

Late or incorrect reporting triggers fines

Missing data defaults conservatively

Repeated non-compliance risks fleet-wide port bans

4. Where auditors actually focus (and where companies fail)

Auditors test completeness, consistency, and bias.

Expect scrutiny on:

Manual data entry points

Fuel density conversions

Auxiliary engines and boilers

Data gaps and surrogate assumptions

Mid-year vessel handovers

Biofuel zero-rating claims

If emissions occurred, they must appear somewhere in the verified trail. If your monitoring plan leaves discretion, auditors will test whether it creates bias.

5. The commercial evolution

These mechanics are not neutral. They are reshaping contracts.

Fuel is now sold with regulatory attributes

Charter parties are renegotiating EUA pass-throughs

Surcharges replace flat bunker pricing

Hedging strategies become operational necessities

Counterparty risk extends into carbon markets

This is why maritime decarbonisation now sits squarely between trading, legal, operations, and finance, not sustainability teams.

The Bottomline

The companies that win won’t be the ones with the loudest net-zero claims.

They’ll be the ones who understand how rules turn molecules into numbers, and numbers into money.

If you’re serious about operating, supplying, or investing in maritime fuels today, this isn’t optional knowledge anymore. It’s the operating system.