Maritime Regulation & Recognition

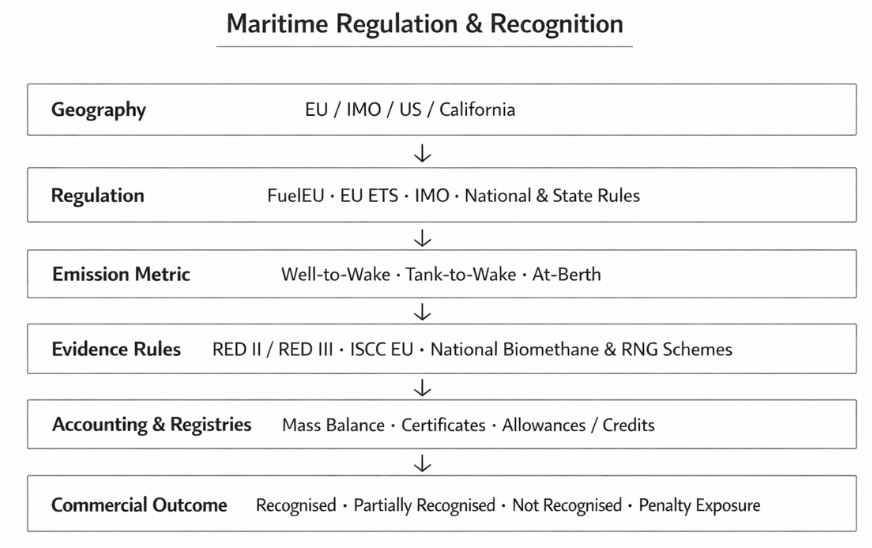

Shipping decarb is now an accounting game with real financial implications. The same molecule can look “clean” in one place and “non-existent” in another, depending on the rulebook, metric, and registry trail.

This explainer aims to provide a practical recognition matrix by geography + sector summary, based on EU renewable energy law (RED II / RED III), certification systems (ISCC EU), shipping regulations (FuelEU Maritime, EU ETS), and national biomethane/RNG schemes.

TLDR: The recognition matrix (the part to remember)

EU shipping: WtW and TtW; backed by RED + certification

IMO: WtW — not fully operational yet

US federal: lifecycle intensity (proposed)

California: local air emissions at berth

Biomethane/RNG: recognition depends on national schemes + registry acceptance

Maritime industry winners won’t be the companies with the boldest net-zero claims, but the ones that understand how regulation turns emissions into accounting entries, and accounting entries into money.

EU / EEA — where rules already hit cash flows

Who is in scope : Commercial cargo and passenger ships; ≥ 5,000 GT

How emissions are counted

FuelEU Maritime: Well-to-Wake (WtW) lifecycle emissions, effective Jan 2025

EU ETS (Maritime): Tank-to-Wake (TtW) stack emissions, effective Jan 2024

What determines recognition

Lifecycle values come from regulatory defaults, unless proven otherwise

Sustainability claims rely on RED II / RED III rules; importance of feed under annex 9

Mass-balance accounting is allowed, but only with approved certification

ISCC EU is commonly used to evidence sustainability and traceability

Important nuance

100% of emissions counted for intra-EU voyages

50% for EU ↔ non-EU legs

Certain “nearby” container transhipment hubs do not reset voyage accounting

Note to Shipowners invested in the LNG pathway: EU ETS 2026 scope expansion from CO2 to the inclusion of methane (CH4) and nitrous oxide (N2O). If your vessels use Low-Pressure Otto-cycle engines, which have a default slip factor of up to 3.1%, the ETS costs could spike significantly. I would advise that the CAPEX for a High-Pressure engine (with a 0.2% slip factor) may be the only way to avoid the "Methane Cliff" and punitive FuelEU penalties.

What this means

FuelEU shapes fuel choice. ETS prices non-compliance.

International (IMO): the global lane, pending

Who is in scope: International shipping, ≥ 5,000 GT

How emissions are counted: Moving toward Well-to-Wake accounting

Status: Net-Zero Framework under negotiation; Adoption pushed to October 2026

What this means

IMO will matter long-term. But regional systems (especially the EU) are setting the rules first.

United States (Federal) — lifecycle logic, limited enforcement

Who is in scope: Commercial vessels; ≥ 400 GT (per proposed legislation)

How emissions are counted: Lifecycle carbon intensity (gCO₂e per unit energy)

Policy direction

Clean Shipping Act of 2025 (proposed)

Focus on green corridors and technology deployment

What this means

U.S. is aligning conceptually with lifecycle thinking, closer to FuelEU than ETS, but penalties are not yet the main driver.

United States, California — local air beats global carbon

Who is in scope: Ocean-going vessels calling at regulated California ports; Includes container, tanker, Ro-Ro, cruise (by phase-in)

What is regulated: At-berth emissions, not fuel lifecycle

Compliance requirement

Shore power or

CARB-approved emission capture systems

Applied per port visit

What this means

Even a “green” fuel doesn’t exempt you from local air rules. Different problem. Different compliance stack.

National biomethane & RNG schemes

These schemes don’t regulate ships directly. They determine renewable gas attributes.

Germany: registry-based biomethane tracking (gas grid accounting)

UK: RTFO credits for transport fuels; separate gas certificates with no automatic EU recognition

Italy: transport-focused biomethane credits (CICs)

USA: RNG tracked via RINs under the Renewable Fuel Standard

Critical point

Certificates are not universally portable. Recognition depends on:

accepted sustainability rules,

chain-of-custody logic,

and registry controls that prevent double counting.