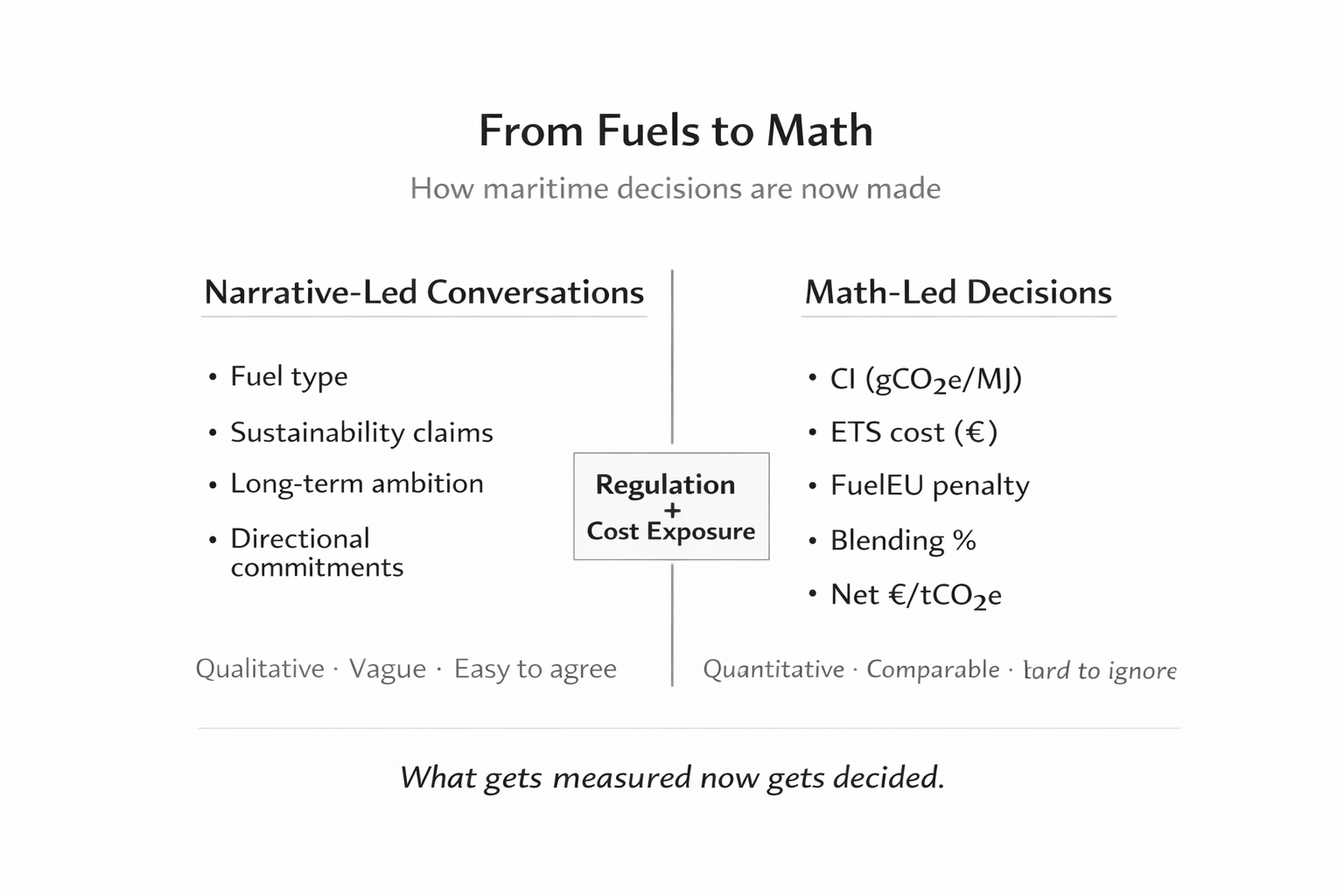

From Fuels to Maths: How Maritime Conversations Are Changing

This is a learning note. Written for maritime practitioners, bunker suppliers, and shipowners who are trying to make sense of FuelEU, ETS, and why every serious conversation now sounds like a spreadsheet.

The old conversation: “What fuel should I bunker?”

For decades, bunkering conversations were operational and tactical:

What fuel is available in this port?

Is it compliant?

What’s the delivered price per tonne?

Can my engine burn it safely?

Decarbonisation has ended that era. Not that fuel doesn’t matter anymore, but because fuel choice is now just one variable inside a compliance equation.

The new conversation: “What is my cheapest path to compliance?”

FuelEU Maritime and EU ETS care only about measurable outcomes, expressed in numbers:

grams CO₂e per MJ

tonnes CO₂ emitted

allowances surrendered

penalties avoided (or paid)

From this point on, maritime decarbonisation is not a fuel transition first. It is a compliance optimisation problem.

FuelEU vs ETS — they are not the same problem

Most confusion comes from treating FuelEU and ETS as one policy. They’re not.

ETS: You pay for what you emit

ETS prices absolute emissions. If you burn fuel and emit CO₂, you owe allowances. It doesn’t matter how efficient your ship is or what fuel you use. It only cares how much CO₂ comes out.

Think of ETS as a carbon tax with a variable price. Simple mental model: “Tonnes of CO₂ × carbon price = cash out.”

FuelEU: You are penalised for being above a benchmark

FuelEU is different, think of it as a speed limit. FuelEU sets a declining greenhouse-gas intensity target. You are compared against that benchmark. If your fuel mix is dirtier than required → penalty. If it’s cleaner → surplus (which can be banked, pooled, or traded).

Simple mental model: “How far am I above or below the required gCO₂e/MJ — and over how much energy?”

Why this changes bunkering conversations completely

Here’s the key change, and it took me time to internalise:

No customer buys biomethane because it’s green.

They buy it because it is a tool to manage compliance cost.

Once you accept that, the conversation becomes clearer, and more honest.

A simple example

Assume a vessel operating in EU waters that burns LNG, and faces ETS cost on emissions and FuelEU penalty for missing the intensity target

Now introduce biomethane (or Bio-LNG), but only partially.

Scenario A: Do nothing

Burn fossil LNG

Pay: ETS allowances, FuelEU penalty

This is the baseline compliance cost.

Scenario B: Blend 10–20% biomethane (via mass balance)

This is where Math fun comes in.

ETS - Biomethane is treated as near-zero CO₂. You reduce ETS exposure proportionally.

FuelEU - The average fuel intensity improves. Penalty shrinks, or flips into surplus.

The real question is : Is the cost of biomethane lower than the compliance cost it avoids?

What future bunkering conversations will actually sound like

Instead of expecting questions like: “Is this fuel green?” or “How much is this green fuel?”

Expect more questions like:

“What’s my ETS exposure per voyage?”

“Where does FuelEU penalty start to dominate?”

“At what blend percentage do I flip from penalty to surplus?”

“Can I pool compliance across my fleet?”

The bottom line

Compliance economics is the decision engine, and critical to the progress of maritime decarbonisation. Regulators care about different things, so it is critical that you become conversant in all policies that apply. For example:

ETS cares about absolute emissions

FuelEU cares about energy-normalised intensity

IMO (for completeness) cares about fleet-level monitoring and benchmarking